indiana estate tax form

Indiana levies no state taxes on the inheritance or estates of residents and nonresidents who own property there. Use Form IT-40 if you and your spouse if married filing jointly were full-year Indiana residents.

How Long Does A Speeding Ticket Stay On Your Record D Turner Legal Llc Speeding Tickets Records Ticket

The final income tax.

. These taxes may include. For more information please join us for an upcoming FREE seminar. Her and is not subject to Indiana inheritance or estate tax and further says under the penalties for perjury that.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. An Indiana small estate affidavit is used to gather the assets of a person who has died and left behind an estate worth less than. Estate tax is one of two ways an estate may be taxed.

No tax has to be paid. In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended. Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41. Therefore you must complete federal Form 1041 US.

INDIANA PROPERTY TAX BENEFITS State Form 51781 R14 1-20 Prescribed by the Department of Local Government Finance THIS FORM MUST BE PRINTED ON GOLD OR YELLOW PAPER. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption allowed for that beneficiary if the property transferred is Indiana real property andor tangible personal property located in Indiana. Step 3 Make a List of All Estate Items.

Once the application is in effect no other filing is necessary unless there is a. If you need to contact the IRS you can access. Form IT-40PNR for Part-Year and Full-Year Nonresidents Use Form IT-40PNR if you and your.

This list should include any real estate. The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate. 48845 Employees Withholding Exemption County Status Certificate.

Inheritance tax was repealed for individuals dying after Dec. Inheritance tax applies to assets after they are passed on to a persons heirs. Ad The Leading Online Publisher of National and State-specific Legal Documents.

APPLICATION FOR PROPERTY TAX EXEMPTION State Form 9284 R10 11-15 Prescribed by Department of Local Government Finance Assessment date January 1 20____ County Name of. If you have additional questions or concerns about estate planning and taxes contact an experienced. The Indiana income tax rate for.

There is also a tax called the inheritance tax. The easiest way to complete a filing is to file your individual income taxes online. The estate tax rate is based on the value of the decedents entire taxable estate.

We offer thousands of Indiana forms. Applicants must be residents of the State of Indiana. Form to be filed by executors of an estate and other persons required to file Form 706 or Form 706-NA to report the final estate tax value of property distributed or to be.

Property tax forms are managed by the Indiana Department of Local Government Finance not the. Print or type your full name Social Security number. The statements herein are true and correct to the best of such persons.

Printable Indiana state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax. Applications must be filed during the periods specified.

Indiana Personal Form Categories Indiana State Tax Forms 2021. Of all the states Connecticut has the highest exemption amount of 91 million. Use this form to initiate a property tax appeal with your Indiana county.

Level and file Form IT-41 at the Indiana level. Indiana Current Year Tax Forms. The amount of tax is determined by the value of those.

Many of the necessary determinations are done at the federal level by the IRS. Do I Need a Living Trust in Indiana. Therefore you must complete federal Form 1041 US.

Does Indiana Have an Inheritance Tax or Estate Tax. Get Access to the Largest Online Library of Legal Forms for Any State. Updated April 04 2022.

A Current Assets List can be used when planning the distribution of an individuals estate. Indiana Substitute for Form. Annual Withholding Tax Form Register and file this tax online via INTIME.

Individual Income Tax Forms. Indiana State Law 29-1-8-1 mentions that a trust is not necessary for a person to avoid the probate process if they have fifty-thousand. Federal tax forms such as the 1040 or 1099 can be found on the IRS website.

For your convenience we provide some of the personal form categories below. Forms downloaded and printed from this page may be used to file taxes unless otherwise specified. Returns are processed faster refunds are issued in a matter of days and.

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes

:max_bytes(150000):strip_icc()/Screenshot2020-11-28at10.55.14AM-e223e6370bbf48939577bbd00f667d4b.png)

Form 8689 Allocation Of Individual Income Tax To The U S Virgin Islands Definition

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

Arkansas Quit Claim Deed Form Quites The Deed Arkansas

Tax Form Templates 5 Free Examples Fill Customize Download

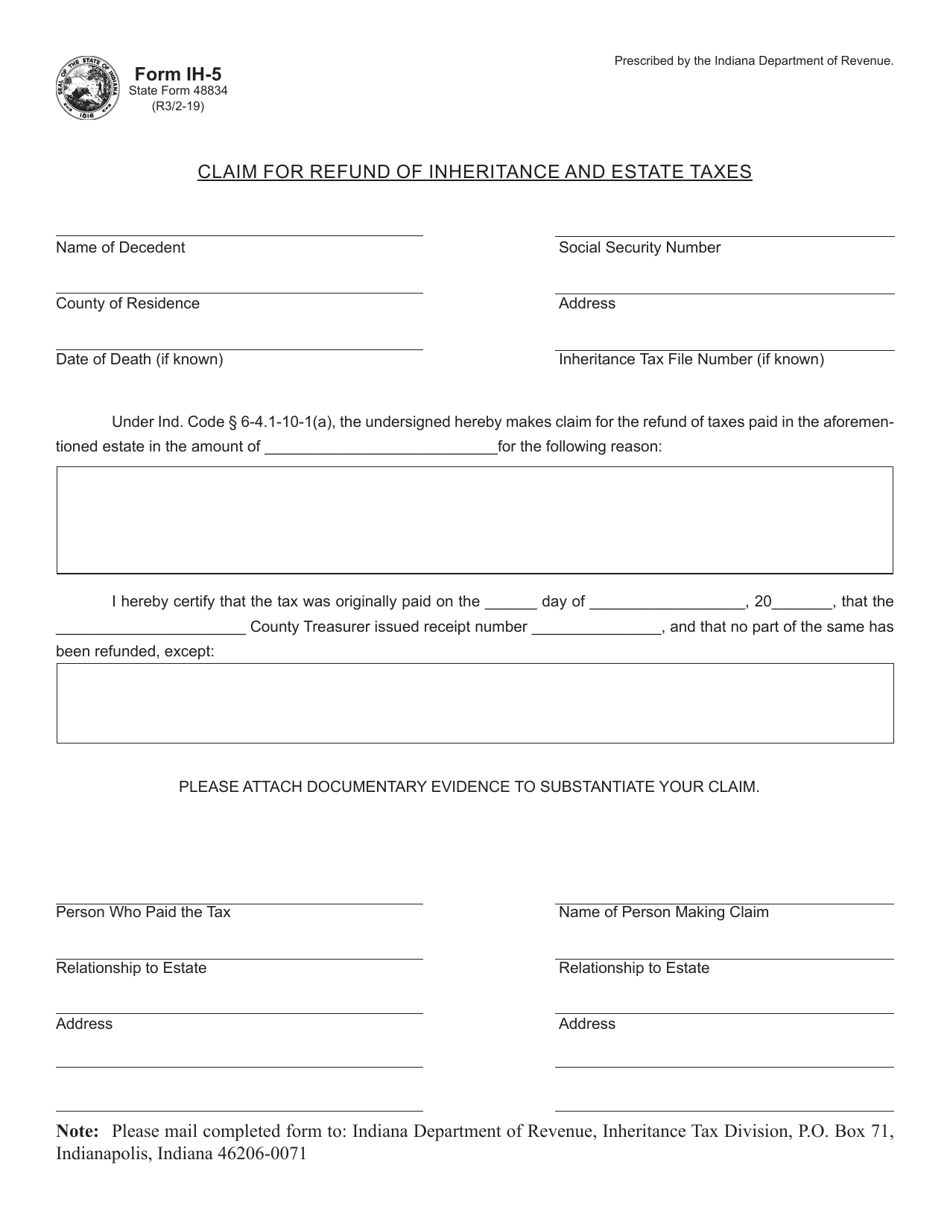

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

Understanding The 1065 Form Scalefactor

Tax Form Templates 5 Free Examples Fill Customize Download

Pin On Real Estate Infographics

Basics Of Estate Planning Trusts And Subtrusts American Academy Of Estate Planning Attorneys Estate Planning Estate Planning Attorney Revocable Living Trust

Credit Union Forms Output Services From Oak Tree Business Systems Inc Credit Union Business Systems Credit Card Application

W9 Form Printable Indiana Blank W9 Form 2022

Tax Form Templates 5 Free Examples Fill Customize Download

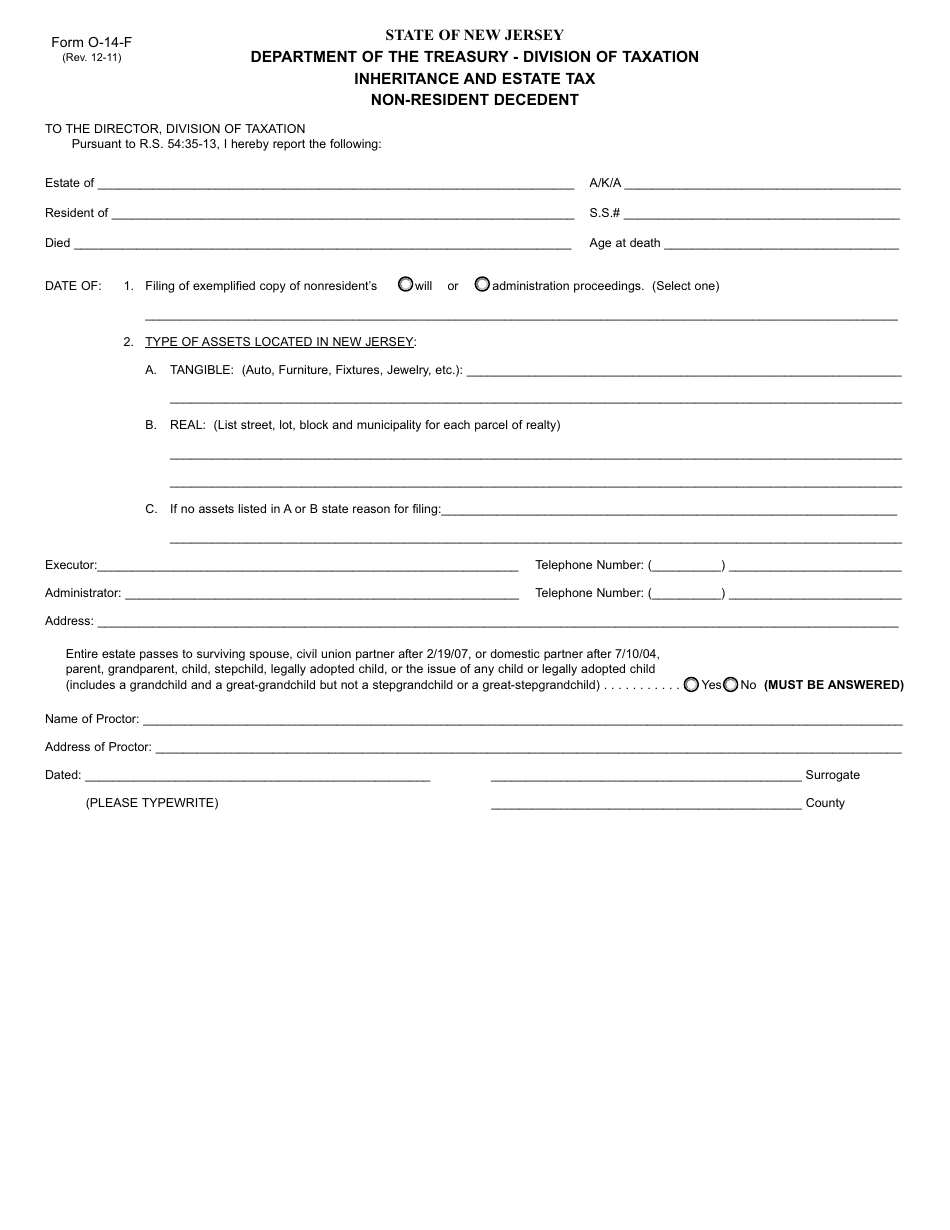

Form O 14 F Download Fillable Pdf Or Fill Online Inheritance And Estate Tax Non Resident Decedent New Jersey Templateroller

Why Some Americans Should Still Wait To File Their 2020 Taxes

How To File Taxes For Free In 2022 Money

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)